State Budget Portugal 2025: Tax Proposals

State Budget Portugal 2025: Tax Proposals

The government's 2025 State Budget Law Proposal was presented to the Portuguese Parliament on 10 October, published in Diário da Assembleia da República, and began to be discussed in Parliament on 30 October.

I. PRESENTATION OF THE STATE BUDGET PROPOSAL

PUBLICATION

The State Budget Law Proposal for 2025 was presented to the Portuguese Parliament on 10 October and published in Diário da Assembleia de República.

DISCUSSION, VOTE AND ENTRY INTO FORCE

The discussion and general vote were scheduled for 30 and 31 October, and the discussion and special vote are expected to take place between 22 and 29 November, with the discussion and final overall vote on 29 November, so that the law can then be promulgated by the President of the Republic, published and enter into force on 1 January 2025.

THE MACROECONOMIC SCENARIO

For reference, we present the macroeconomic growth estimates and forecasts, in percentage points, from the Ministry of Finance, the Organisation for Economic Co-operation and Development (OECD), the European Commission and the International Monetary Fund (IMF).

Source: State Budget Report 2025 (table 1.3) and Portuguese Public Finance Council (CFP)

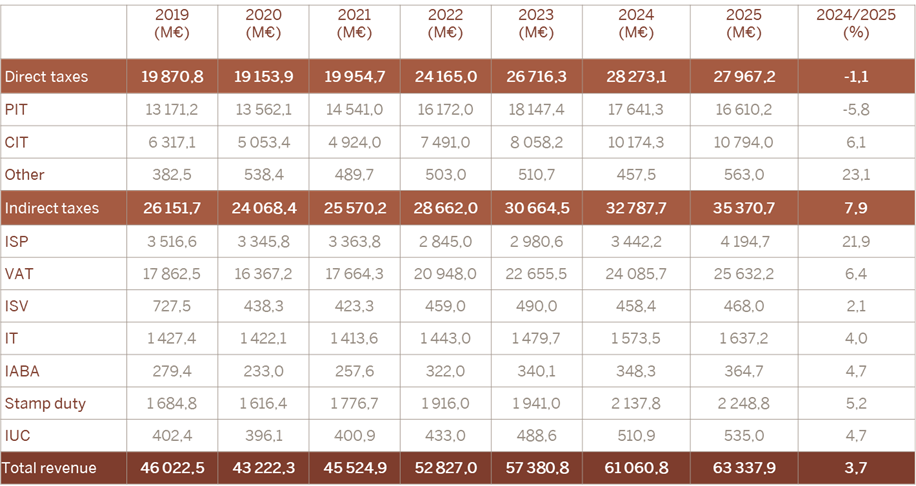

TAX REVENUES

For reference purposes, the evolution and breakdown of the various tax revenues from 2019 to next year 2025 is also shown below, as well as the corresponding variation between 2024 and 2025.

Source: State Budget Reports 2025, 2024, 2023 and 2022

II. THE IMPACT OF THE STATE BUDGET PROPOSAL ON PIT FOR YOUNG TAXPAYERS (IRS JOVEM)

With the 2025 State Budget Proposal, the Government is presenting a change to the PIT applicable to young taxpayers (IRS Jovem), expanding its scope to cover all taxable persons up to the age of 35, as long as they are not considered dependents.

Previously, the regime was limited to young people between the ages of 18 and 26, with the requirement of having completed a cycle of secondary school studies passing to the university studies cycle, and up to the age of 30 for those studying for a doctorate.

With the new proposal, the completion of any cycle of studies is no longer a requirement, and the need for schools to communicate the completion of these cycles is also eliminated, which simplifies the access to the regime, making it more inclusive.

DURATION

The State Budget Proposal provides for a PIT exemption to be granted for the first 10 years on which the taxpayer receives income from categories A (income from dependent work) and B (business and professional income), regardless of the taxpayer's level of education.

It is proposed that the exemption be gradual and with a limit of 55 times the value of the Social Support Index (IAS), which in 2024 is set at € 509.26, thus corresponding to a maximum exemption limit of € 28,009.30 (subject to updating depending on the value of the IAS).

This limit standardises the amount applicable to all years of exemption, replacing the previous scale, which ranged from 40 times the IAS in the first year to 10 times the IAS in the fifth (and final) year.

Hence, the intention is for this exemption to be progressive over 10 years, applying as follows:

- 100% in the first year of earning income

- 75%, from the 2nd to the 4th year of earning income

- 50%, from the 5th to the 7th year of earning income

- 25%, from the 8th to the 10th year of earning income

If, in any of the years, the taxpayer does not earn income from categories A or B, the exemption will not be applied in that year, but it can be resumed in subsequent years, always respecting the total limit of 10-year application and as long as the maximum age of 35 is not exceeded.

This allows taxpayers the chance to benefit from the regime with more flexibility, without being penalised for years in which they did not earn income from these categories.

For the purposes of determining the exemption percentage applicable to each year, taxpayers will be categorised according to the percentage corresponding to the number of years on which they have already received income from categories A or B.

Years in which the taxpayer was considered a dependent are not counted for this purpose, thus ensuring greater fairness in the application of the tax exemption.

EXCLUSIONS

State Budget Proposal also provides for certain exclusions that prevent access to this benefit. In this sense, are not eligible for this special regime taxpayers who:

- have benefited or are benefiting from the regime of Non-Habitual Residents (NHR)

- have benefited or are benefiting from the tax incentive regime for scientific research and innovation, as provided for in the Statute of Tax Benefits (EBF)

- have opted for the regime for former residents (Programa Regressar)

- do not have their tax situation regularised with the Tax Authority

WITHHOLDING TAX

For the purposes of applying the withholding tax rules, in the case of category A income, for the exemption to be applied the taxpayers must inform the entities responsible for the correspondent payment of the year in which they currently are, (not being necessary to provide proof of completion of a course of study, which will no longer be relevant under the regime). This simplification of the communication process facilitates the access to the special tax regime.

This will not be the case for taxpayers who have category B income. In these cases, as already provided for in the regime currently in force, whenever the entity paying the income have or must have organised accounting, there is an obligation to withhold tax at source (on all the income earned).

The main goal of the proposed amendment to the IRS Jovem regime is to encourage young people to remain in the labour market, as well as to contribute to their financial stability by progressively reducing the tax burden on income earned during the first years of professional activity.

By proposing to extend the scope of the benefit up to the age of 35, and with a validity of 10 years, the regime is seen as an important mechanism for attracting and retaining young talent in Portugal, while promoting greater tax justice by simplifying the access procedures.

III. THE IMPACT OF THE STATE BUDGET PROPOSAL ON FAMILIES

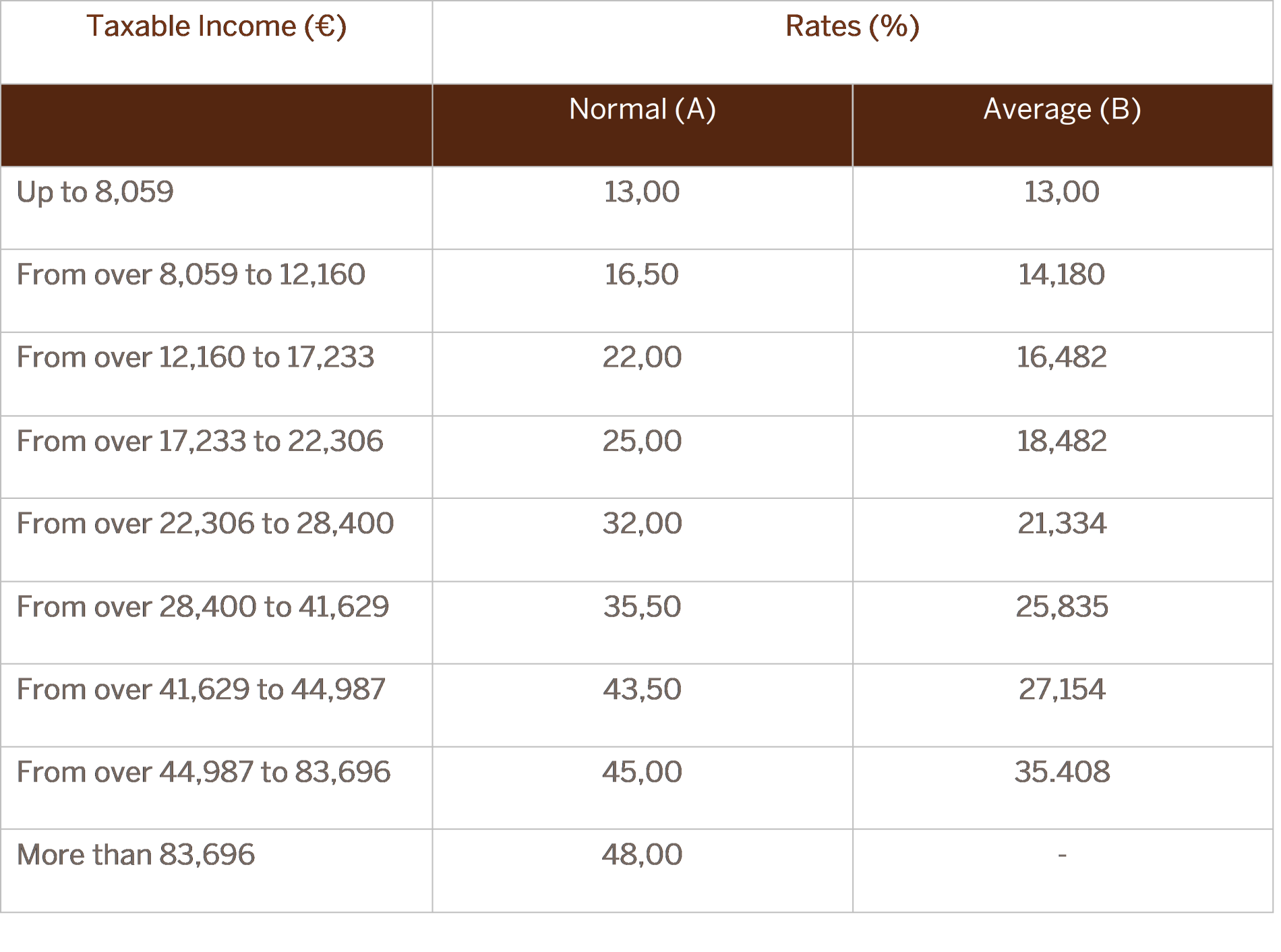

UPDATING THE BRACKETS

The State Budget Proposal proposes that the current nine IRS brackets be updated by 4.6 per cent, keeping the current rates unchanged:

In this sense, the proposed update to the brackets is higher than the inflation rate forecast for 2025, which is estimated at 2.3 per cent.

SPECIFIC DEDUCTION - CATEGORIES A AND H

It is planned to update the fixed specific deduction amount applicable to category A income, specifically from the current amount of € 4,104 to 8.54 times the value of the IAS, and that this same specific deduction amount will also apply to category H income.

It is not yet possible to quantify the amount of the proposed deduction, which will be updated according to the value of the IAS applicable in 2025. Considering the value of the IAS in 2024, the amount of the specific deduction proposed would be € 4,349.08.

FOOD ALLOWANCE

It is proposed to increase the legal limit from 60 per cent to 70 per cent of the non-taxable meal allowance paid through meal vouchers.

The proposal therefore changes the daily rate from € 9.6 to € 10.20.

MINIMUM EXISTENCE

The State Budget Proposal proposes updating the reference value of the minimum subsistence level, which should correspond to the highest value between € 12,180 and 1.5 x 14 x IAS.

Considering the proposed value of the guaranteed minimum monthly wage, which is set at € 870 in 2025, the reference value of the minimum subsistence amount will be updated in line with this increase, and taxpayers earning low gross monthly incomes will remain exempt from personal income tax.

WITHHOLDING TAX - CATEGORY B

With regard to category B income from professional activities specifically provided for in the table attached to the IRS Code, it is proposed to reduce the withholding tax rate from 25 per cent to 23 per cent.

PAYMENTS ON ACCOUNT

The State Budget Proposal proposes a reduction in the amount of payments on account due by taxpayers earning Category B income, which results from the proposal to change the proportion applicable to the calculation formula to 65 per cent, instead of the 76.5 per cent currently in force.

AUTONOMOUS TAXATION

It is proposed to update the limit for the cost of acquiring light passenger or mixed-use vehicles from € 20,000 to € 30,000 for the purposes of applying autonomous taxation on the costs incurred by taxable persons who have or should have organised accounts, in the context of carrying out a business or professional activity, while maintaining the exclusion already in force for exclusively electric vehicles.

ENCOURAGING COMPANY RECAPITALISATION

It is proposed to broaden the scope of the incentive to recapitalise companies, so that the applicability of the tax benefit is no longer dependent on the economic situation of the companies and can be applied to companies in general.

Thus, the State Budget Proposal provides for the possibility of deducting 20% of the capital contributions in cash made by the IRS taxpayer in favour of a company in which he holds a shareholding, from the gross amount received as profits or, in the case of the sale of the shareholding, from the balance calculated between the capital gains and losses realised.

There is, however, an exclusion to the applicability of this tax benefit in the case of capital contributions to entities subject to supervision by the Bank of Portugal or the Insurance and Pension Funds Supervisory Authority, branches in Portugal of credit institutions, other financial institutions or insurance companies.

IV. THE IMPACT OF THE STATE BUDGET PROPOSAL ON SALARIES

GUARANTEED MINIMUM MONTHLY SALARY

In view of the agreement reached with the Social Partners, where it was considered that salaries should ensure the preservation of employees' real purchasing power and contribute to increasing convergence with the European average, the government will increase the minimum monthly salary by around € 50 for 2025 compared to 2024, i.e. an increase to € 870 per month from 1 January.

PRODUCTIVITY, PERFORMANCE, PROFIT SHARING AND BALANCE SHEET’S BONUS

The State budget’s proposal to 2025 provides for exemption from personal income tax (IRS) and the Single Social Tax (TSU) for productivity bonus that do not exceed 6 per cent of the annual basic salary.

The application of this scheme requires employers to increase employees' fixed remuneration by at least 4.7 per cent in 2025, compared to the average annual base per employee for the previous year.

OVERTIME WORK

To boost disposable income, it is also proposed to reduce the withholding rate to be applied to overtime work.

Regarding non-residents who receive income provided to a single entity, it is proposed to increase the number of hours of work or services provided from 50 to 100 not subject to withholding tax, with the remainder hours subject to withholding tax at a rate of 25 per cent.

Concerning tax residents, it is proposed that the withholding tax rate to be applied should be 50% of the rate applicable to the monthly remuneration for dependent labour for the month in which it is paid or made available to the employ, regardless of the number of hours worked as overtime.

V. THE IMPACT OF THE STATE BUDGET PROPOSAL ON BUSINESS AND INVESTMENT

REDUCTION OF NOMINAL CORPORATE INCOME TAX (IRC) RATES

The State Budget Proposal provides for a 1% reduction in the general rate (proposed to be 20%) and the reduced rate (proposed to be 16%) of corporate income tax, a proposal that has been widely publicised and announced, but which falls short of what the government initially intended, particularly in its programme.

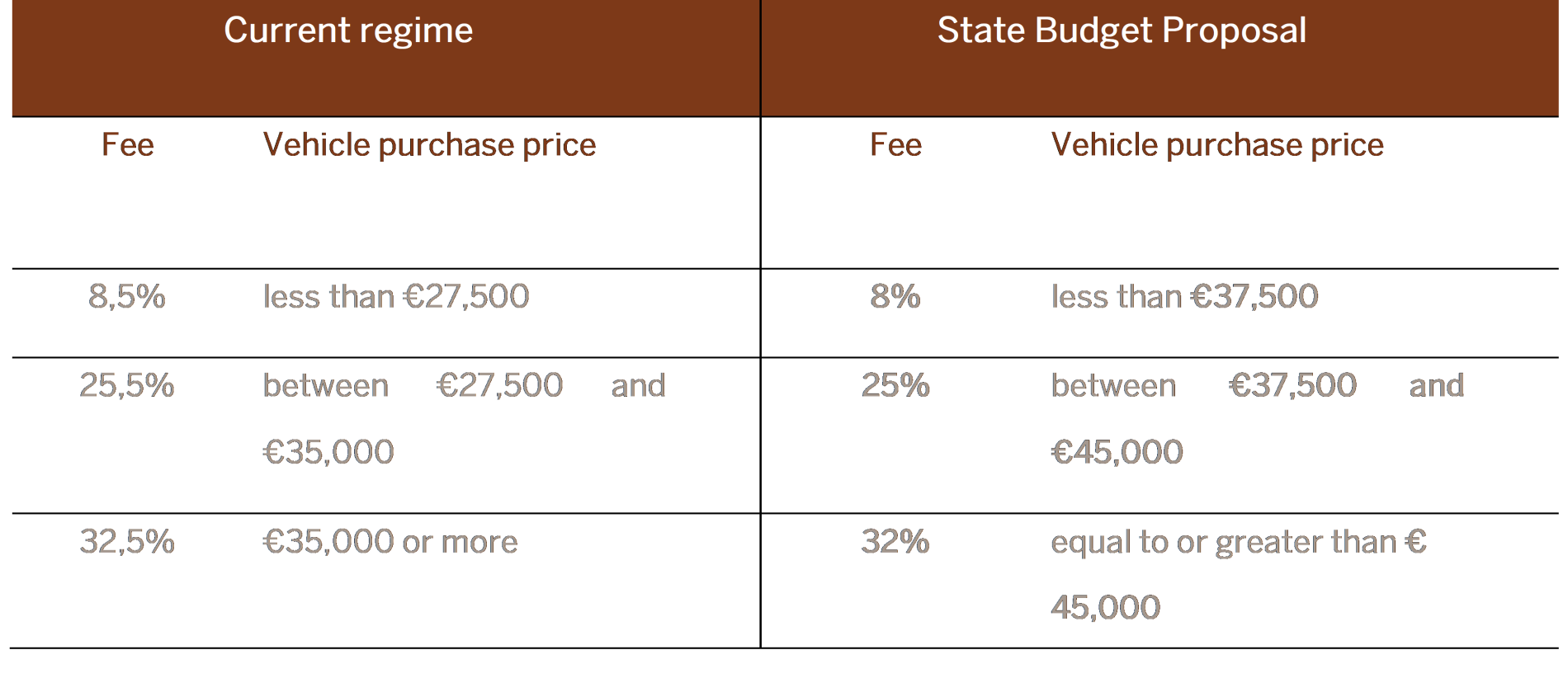

AUTONOMOUS TAXATION RATES - CHARGES FOR PASSENGER CARS, LIGHT GOODS VEHICLES, MOTORBIKES OR MOTORBIKES

A sharp reduction in autonomous taxation on purchases by companies of light passenger vehicles, light goods vehicles, motorbikes or motorbikes is planned, proposing not only a 0.5 per cent reduction in the rates, but also a change in the applicable brackets, as follows:

AUTONOMOUS TAXATION RATES - ENTERTAINMENT COSTS

Regarding the autonomous taxation applicable to representation expenses, it is proposed to remove its application to entertainment expenses - in other words, it is proposed that such expenses should not be subject to autonomous taxation, currently subject to a rate of 10 per cent.

AUTONOMOUS TAX RATES - (NON) INCREASE IN CASE OF TAX LOSSES

By 2025, it is expected that the 10 per cent increase in autonomous taxation rates will be suspended in the case of companies with tax losses, when they have submitted their IRC Model 22 Declarations and IES on time and when:

- the company has made a taxable profit in one of the three previous tax periods, or

- such periods correspond to the tax period of commencement of activity or to one of the following two periods

TAX INCENTIVES FOR COMPANY CAPITALISATION

Adjustments are planned to this incentive scheme, created in the 2023 State Budget Law and amended in the 2024 State Budget Law, which provides for a deduction from the tax base resulting from the application of a rate, made up of a spread and the average of the 12-month Eurobor rate in the year in question, to eligible net increases in equity.

These adjustments are expected to be along the following lines:

- access to the 2 per cent spread for companies in general, as opposed to the current situation, where this spread is only applicable to SMEs or small mid caps

- maintaining the 50 per cent increase in the deduction in 2025, in line with the increase applicable in 2024 and contrary to what is currently planned for 2025 (30 per cent increase)

TAX INCENTIVE SCHEME FOR SALARY VALORISATION

The State Budget Proposal provides for the clarification of concepts applicable in the context of this scheme, as well as providing for a reinforcement of this tax incentive, through the following proposals:

- deduction of 200 per cent (currently 150 per cent) of the cost of salary increases

- the eligible increase in the average annual basic salary per employee is expected to lower from 5 per cent to 4.7 per cent

- increase in the maximum amount of deduction per worker from 4 to 5 times the minimum wage

- elimination of the requirement regarding the difference in salary range, despite the proposal to introduce a requirement for a minimum increase of 4.7 per cent in the salary of workers earning equal to or less than the company's average salary

SOCIAL UTILITY REALISATIONS - HEALTH OR SICKNESS INSURANCE COSTS

It is proposed to increase the deduction, to 120 per cent, for the cost of health or sickness insurance contracts taken out by companies for the benefit of their workers.

NEW EXTENSION FOR THE DELIVERY OF THE SAF-T ACCOUNTING FILE

It is expected that the submission of the SAF-T (PT) file relating to accounting will be extended once again for the 2026 and following periods, to be delivered in 2027 or in subsequent periods.

VI. THE IMPACT OF THE STATE BUDGET PROPOSAL ON CONSUMPTION

A. VALUE ADDED TAX (VAT)

CONTRACTS FOR THE CONSTRUCTION OR REFURBISHMENT OF RESIDENTIAL PROPERTIES

It is proposed that the Government be authorised, during 2025, to amend item 2.18 of List I annexed to the VAT Code, in order to: (i) provide that the construction or rehabilitation works for housing properties covered are defined according to criteria established by the members of the Government responsible for the areas of finance and housing; and (ii) exclude from its scope services related to housing properties whose value exceeds the limit compatible with the pursuit of the Government's social housing policies.

VAT EXEMPTIONS

It is proposed to extend, until 31 December 2025, the VAT exemption applicable to transfers of the following goods, when normally used in the context of agricultural production activities: (i) fertilisers, fertilisers and soil improvers; (ii) products suitable for feeding livestock, poultry and other animals listed in the Codex Alimentarius, including farmed fish, intended for human consumption; and (iii) glass bottles.

On the other hand, it is also proposed to extend, until the last day of 2025, the VAT exemption applied to the supply of all products, dry or wet, intended for the feeding of pets when taken in by legally constituted animal protection associations.

REFUND OF AN AMOUNT EQUIVALENT TO VAT

It is planned to extend the benefit associated with the total or partial refund of the amount equivalent to VAT to entities that own forestry brigades, which are part of the Integrated Rural Fire Management System (Sistema de Gestão Integrada de Fogos Rurais), when they are unable to exercise their right to deduct, in respect of movable equipment directly intended for the pursuit of their respective purposes, including the services necessary for the upkeep, repair and maintenance of this equipment.

PDF INVOICES

It is planned to extend the acceptance of PDF invoices until 31 December 2025, and they will be considered as electronic invoices for all the purposes of tax legislation.

GENERAL WASTE MANAGEMENT REGIME - PRINTING INVOICES AND OTHER TAX-RELEVANT DOCUMENTS

It is planned that the ban on the systematic printing and distribution of receipts, as provided for in the General Waste Management Regime, does not jeopardise the printing of invoices and other tax-relevant documents.

B. TAX ON ALCOHOLIC BEVERAGES AND NON-ALCOHOLIC BEVERAGES CONTAINING ADDED SUGAR (IABA)

TAX RATE

There is no proposal to update the rates for alcoholic or sugary drinks, disregarding the expected inflation.

EXTENSION OF RATE REDUCTION

It is planned to extend, until 31 December 2025, the reduction in the IABA rate, set at 25% of the tax, to liqueurs and "crème de", distilled spirits and fruit spirits - in accordance with the provisions of Annex ii of Regulation (EC) No 110/2008 of the European Parliament and of the Council of 15 January 2008 - provided that they are made exclusively from the fruits of the strawberry tree, produced and distilled in the municipalities previously provided for in the legislation in force.

C. TAX ON PETROLEUM AND ENERGY PRODUCTS (ISP)

TAX RATE

The tax rates for petrol and diesel are set by government decree and there is no known intention on the Government to update them.

ELIMINATION OF ISP AND CARBON TAX EXEMPTIONS FOR COAL

It is proposed that fuels classified under CN codes 2701, 2702 and 2704 consumed in the production of electricity or in the production of electricity and heat (cogeneration) no longer benefit from any exemption from either ISP or the CO2 tax.

ELIMINATION OF ISP AND CARBON TAX EXEMPTIONS FOR FUEL OILS

Continuing the progressive elimination of ISP exemptions, fuel oil consumed on the mainland in electricity production will no longer benefit from any exemption in 2023.

PROGRESSIVE ELIMINATION OF EXEMPTIONS FROM THE ISP AND CARBON TAX FOR DIESEL, FUEL OIL AND GASES CONSUMED IN THE AUTONOMOUS REGIONS OF THE AZORES AND MADEIRA

It is proposed that gas oils, fuel oils and gases consumed in the production of electricity and cogeneration in the autonomous regions no longer benefit from any exemption.

PROGRESSIVE ELIMINATION OF ISP AND CARBON TAX EXEMPTIONS FOR MAINLAND GAS CONSUMPTION

It is proposed that, by 2025, gases (CN code 2711) consumed on the mainland in the production of electricity and cogeneration will no longer benefit from any exemption.

MAINTENANCE OF EXEMPTIONS FOR BIOFUELS, GREEN HYDROGEN AND RENEWABLE GASES

Biofuels, green hydrogen and renewable gases continue to benefit from exemption from both ISP and the "CO2 tax".

MAINTAINING THE EXEMPTION FROM THE CARBON TAX FOR COMPANIES IN THE EUROPEAN EMISSIONS TRADING SYSTEM.

It is proposed that companies covered by the European Emissions Trading System (EU ETS – Comércio Europeu das Licenças de Emissão) continue to benefit from the exemption from the Carbon Tax.

D. TOBACCO TAX (IT)

TAX RATE

There is no proposal to update tobacco taxes.

TOTAL MINIMUM REFERENCE TAX

It is proposed that the total minimum reference tax, in force each year, should be the sum of the product of applying the rates of the specific and ad valorem elements of IT and the VAT rate to the national weighted average price of cigarettes.

At the same time, it is also planned the revocation of rules associated with the weighted average taxation of releases for consumption in the Member States of the European Union.

CIGARS AND CIGARILLOS

It is proposed that the minimum tax on cigarillos is changed to 50% of the minimum tax on cigarettes, applicable to cigarettes sold at their weighted average price.

E. STAMP DUTY

DATA TRANSMISSION BETWEEN THE INSTITUTE OF REGISTRIES AND NOTARIES, THE TREASURY AND PUBLIC DEBT MANAGEMENT AGENCY AND THE TAX ADMINISTRATION

It is proposed to include in the Stamp Duty Code rules on the transmission of data between the Institute of Registries and Notaries, I.P. (Instituto dos Registos e do Notariado, I.P.), the Treasury and Public Debt Management Agency - IGCP, E.P.E. (Agência de Gestão da Tesouraria e da Dívida Pública – IGCP, E.P.E.), and the Tax administration (Administração tributária), particularly in relation to information associated with the date of death and the identification of the deceased, as well as the holders of public debt securities and certificates registered in the name of the person who inherited the property, for the purposes of complying with tax obligations.

CREDIT OPERATIONS FOR THE PURCHASE OF OWN PERMANENT HOUSING

It is proposed to extend the tax exemption, until 31 December 2025, for the following operations related to loans made under the legal housing credit regime and up to the amount of the outstanding capital: (i) a change in the term resulting in tax to be paid, depending on the applicable rate differential; (ii) an extension of the term; and (iii) the conclusion of a new credit agreement, within the scope of the legal housing credit regime, to refinance the debt, covering the respective guarantees provided, as well as the guarantees provided in the event of a change of credit institution or subrogation to the rights and guarantees of the mortgage creditor.

FIXING INSTALMENTS ON MORTGAGE LOANS

It is foreseen that the extension of the tax exemption on the facts set out in item 17.1 of the general table – use of credit – annexed to the Stamp Duty Code, in the context of operations to temporarily fix the instalment and capitalise the amounts deferred in the value of the loan for permanent own housing.

VII. THE IMPACT OF THE STATE BUDGET PROPOSAL ON REAL ESTATE

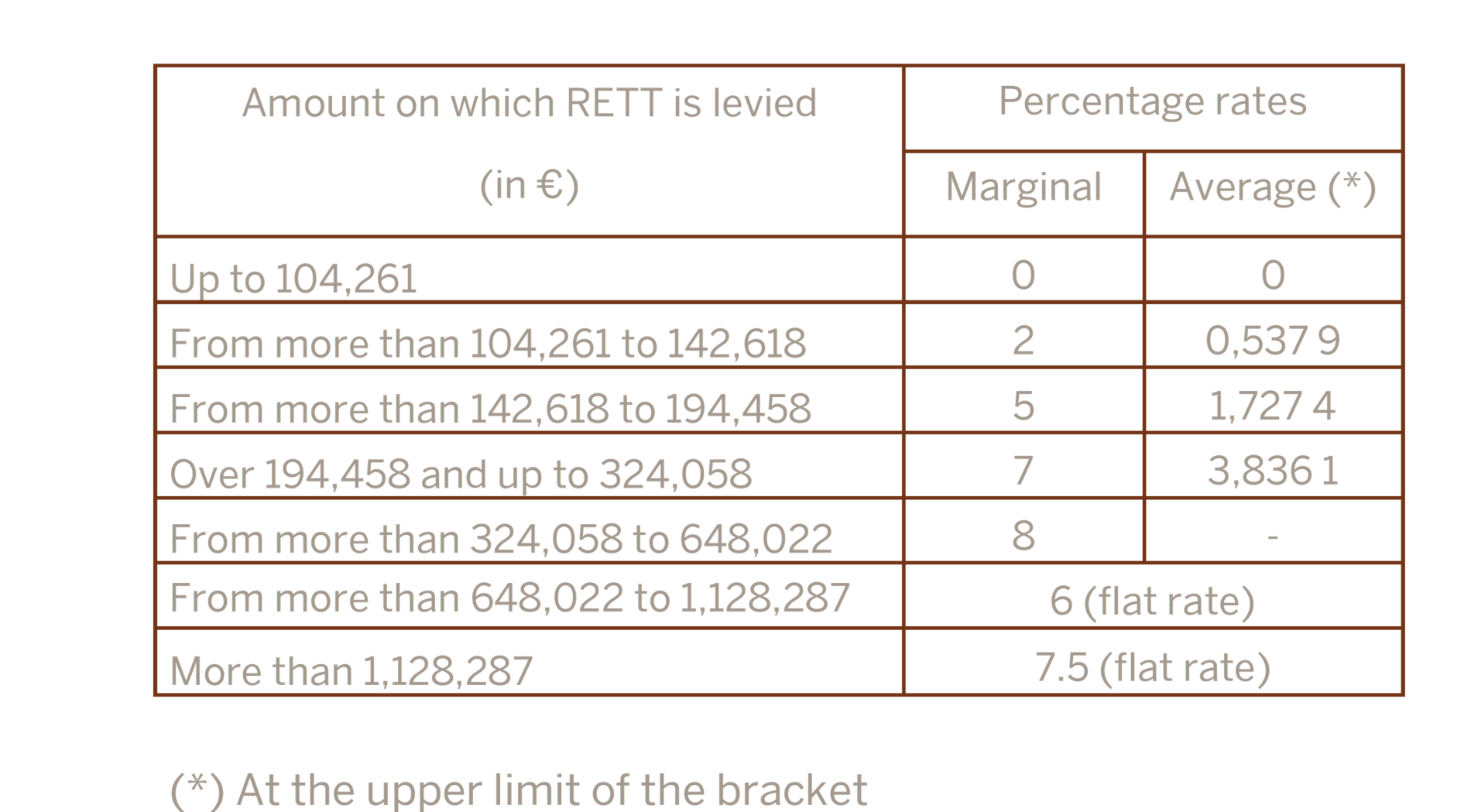

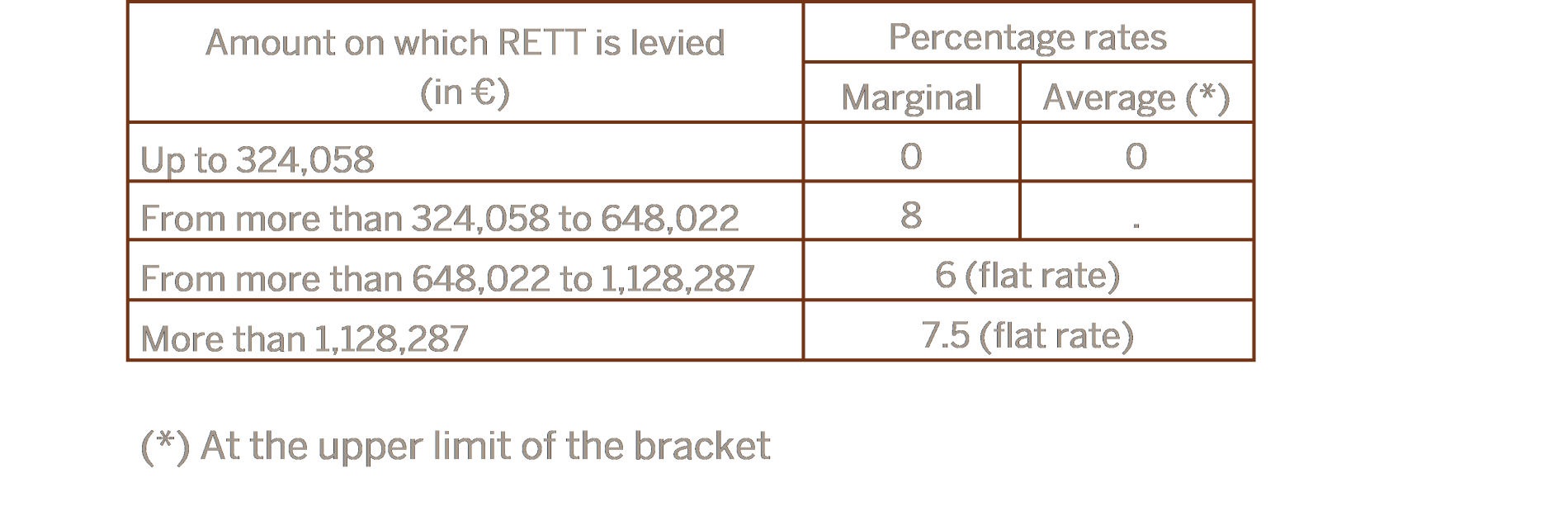

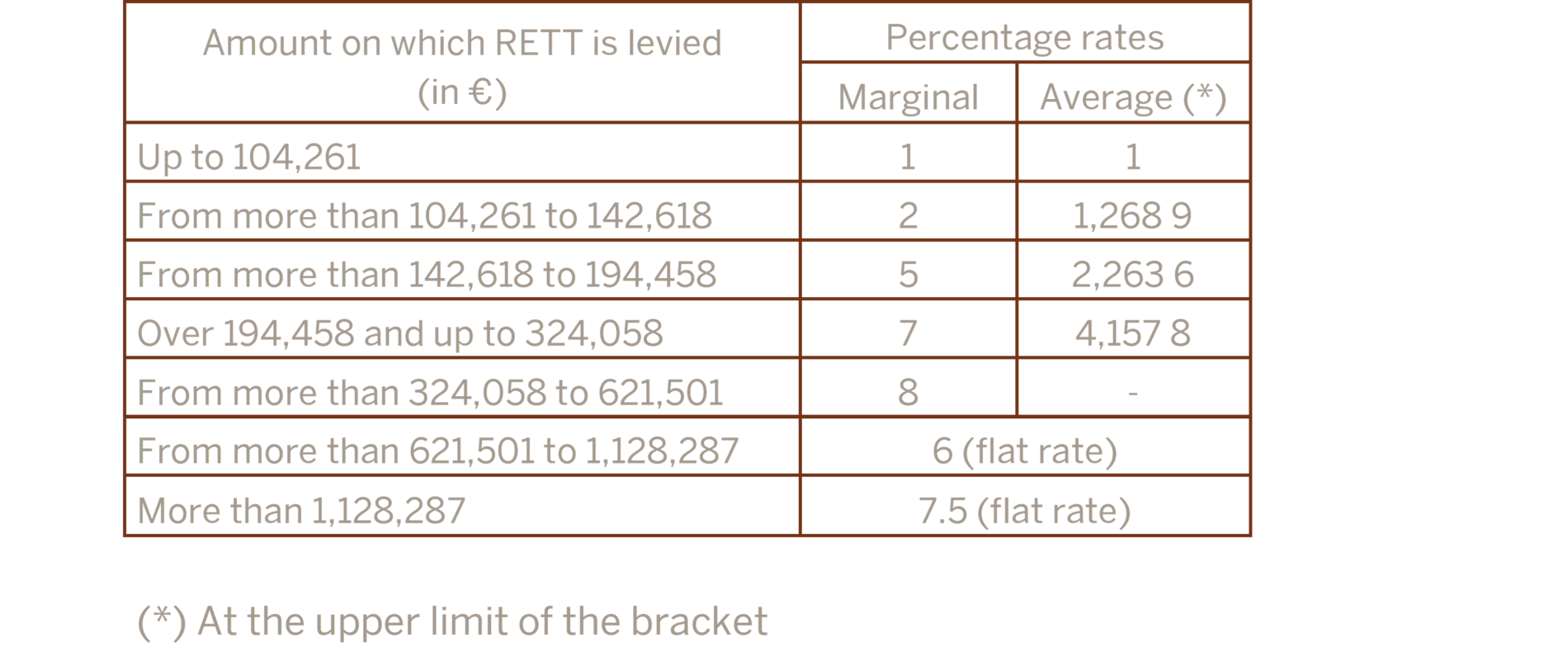

REAL ESTATE TRANSFER TAX (RETT)

There is tax relief on the purchase of an urban building or autonomous fraction of an urban building intended exclusively for residential use.

It is foreseen an update, by 2.3%, of the brackets for determining the RETT rate applicable to the transfer of urban buildings, or autonomous fractions of urban buildings, intended exclusively for residential use, specifically in the following situations:

- acquisition of an urban building or autonomous fraction of an urban building intended exclusively for own and permanent habitation, except those covered by the following paragraph:

- acquisition of an urban building or autonomous fraction of an urban building intended exclusively for own and permanent habitation covered by the RETT Code, the value of which exceeds the maximum value of the 1st bracket of the following table:

- acquisition of an urban building or autonomous fraction of an urban building intended exclusively for residential use, not covered by points a) and b):

VIII. THE IMPACT OF THE STATE BUDGET PROPOSAL ON VEHICLES

A. VEHICLE TAX (ISV)

VEHICLE TAX RATES

There is no proposal to update the tax rates.

INTERMEDIATE RATE

It is proposed to add a new paragraph to the article on average rates for passenger cars registered in another EU Member State.

It is also proposed to apply an intermediate rate, resulting from the application of table A of the Vehicle Tax Code, relating to passenger cars and light mixed-use cars and light goods vehicles, of 25%, to passenger cars registered in another EU Member State between 1.01.2015 and 31.12.2020, equipped with plug-in hybrid engines, whose battery can be charged by connecting to the electricity grid and which have a minimum range, in electric mode, of 25 kilometres.

TAXES ON USED VEHICLES

The tax levied on vehicles with definitive Community licence plates granted by other EU member states is subject to provisional assessment under the rules of the Vehicle Tax Code, to which the reduction percentages already provided for are applied taking into account the cylinder capacity and environmental component, which are linked to the average commercial depreciation of vehicles on the domestic market (proposing dropping the criterion of the average remaining useful life of vehicles).

It is also proposed to standardise table D (foreseen on the Vehicle Tax Code) in terms of the engine capacity component and the environmental component.

B. CIRCULATION TAX (IUC)

EXTENSION OF THE EXTRAORDINARY REDUCTION IN TAX RATES APPLICABLE TO VEHICLES FOR PROFESSIONAL USE

It is proposed that the extraordinary reduction that was set to come into force in 2022 for vehicles for professional use (category D vehicles) also continue into force in 2025. This measure was created at the time to compensate for the increase in the price of diesel.

CIRCULATION TAX RATES

There is no proposal to update the tax rates.

ADDITIONAL IUC FOR DIESEL VEHICLES

It is proposed to maintain the additional IUC.

IX. THE STATE BUDGET PROPOSAL AND TAXPAYERS' GUARANTEES

A. GENERAL TAX LAW

There are no proposals to amend the General Tax Law.

B. TAX PROCEDURE CODE

There are no proposals to amend the Tax Procedure Code.

C. SOCIAL SECURITY

COOPERATION BETWEEN THE TAX AUTHORITIES AND THE GENERAL PENSION FUND

As in the previous State Budget Law for 2024, this proposal presents and maintains a series of measures aimed at increasing transparency and facilitating cooperation between the Tax Administration and the Social Security, especially with regard to debt collection and the control of income declared by taxpayers.

These measures are aimed not only at optimising revenue collection procedures, but also at strengthening the mechanisms for monitoring citizens' compliance with their tax and social security obligations.

To this end, it is proposed to maintain the measure allowing the mutual exchange of data between the Social Security, the General Pension Fund and the Tax Administration, thus ensuring the continuity of the policy of transparency of contributions.

It is also planned to maintain the possibility for the tax authorities, in coordination with the relevant government departments, namely those of the Ministry of Labour, Solidarity and Social Security, to adopt concerted positions with a view to recovering debts from companies in economic difficulties.

It is also planned to maintain the possibility of including taxpayers with social security debts on public lists of debtors, thus continuing the effort to monitor compliance with contribution obligations.

ACCESS TO PUBLIC DATABASES

As already provided for in the State Budget Law for 2024, but now with a special focus on voluntary recovery procedures in the context of enforcement proceedings, it is proposed to maintain the possibility for the Social Security Financial Management Institute and the Social Security Institute to directly access various public databases, including land, trade and vehicle registers, in order to obtain information on the identification of the defendant, the debtor or the head of the couple, as the case may be, and the location of their attachable assets in the context of the recovery of social security debts.

It is also proposed to maintain the government's authorisation to cancel credits and debts held by Social Security institutions in certain situations. These situations include the lack of justification or adequate documentation, irrecoverability due to the lack of attachable assets, the existence of debts that are 20 years old or more, or up to 10 years if the value is less than € 50.00, and in cases where the recovery of the credits in question is not justified.

ELECTRONIC NOTIFICATIONS

Similarly to what was established in the previous State Budget Law for 2024, this Proposal provides for the continued use of electronic communications in various Social Security procedures, namely in the context of submitting applications for social benefits and requests for assistance, allowing social security services to carry out all necessary communications, including decisions, electronically through the Social Security Electronic Communications System.

This proposal also foresees the use of this system by companies, local authorities and other organisations, which will also facilitate procedures related to applications for European funds.

D. DATA INTERCONNECTION BETWEEN JUSTICE, FINANCE AND SOCIAL SECURITY

In order to strengthen the policy of transparency that is to be consolidated by 2025, this Proposal provides for the maintenance of the interconnection of data between the justice, finance and social security sectors.

This interconnection will allow the social security institutions to request information on various categories of data from the tax authorities and the IRN services for the purposes of granting social benefits, recovering unduly paid benefits, combating fraud and tax evasion, as well as in the context of rental contracts under social rental schemes.

The information that can be requested now includes data on the identification of the head of the household of the deceased beneficiary and the existence of immovable and movable property subject to registration.

E. ASSET MOBILISATION AND RECOVERY OF STATE CREDITS

As already provided for in the 2024 State Budget Law, this proposal includes a number of measures aimed at making the process of debt collection by the State more flexible, as an alternative to compulsory collection.

Among the main measures, it is proposed to maintain the possibility for the government to renegotiate debts, allowing them to be paid immediately or in instalments. However, the proposal preserves the possibility for the government to reinstate the original payment terms in the event of default.

In the specific context of instalment payments, it is proposed to maintain the government's power to suspend tax enforcement proceedings while the instalment plan is in force.

It is also proposed to maintain the possibility of total or partial cancellation or redefinition of the payment terms for loans taken out by individuals under the special programme for the repair of dilapidated dwellings or properties and the special self-construction programme, in the case of borrowers whose households have an average monthly per capita income that does not exceed the amount of the social insertion income, or borrowers who are clearly financially incapable, thus easing the pressure on the most vulnerable debtors.

The proposal also maintains the possibility for the government to convert credits held by the state into shares in debtor companies.

It is also proposed to maintain the possibility of accepting real estate, furniture or other financial assets as payment for debts, thus allowing debtors to fulfil their obligations by handing over these assets.

The proposal also provides for the exchange of assets with other public entities and the exercise of preferential creditor rights by the State in bankruptcy or tax enforcement proceedings, thus ensuring the recovery of assets for the State.

Finally, the possibility of extinguishing debts through "confusion" is maintained in cases where the State is both creditor and debtor of the same obligation.

F. COSTS OF PROCEEDINGS

The 2025 State Budget proposal maintains the value of court fees in force in 2024 until the new Court Fees Regulation comes into force.

X. THE STATE BUDGET PROPOSAL AND TAX OFFENCES

There are no proposals to amend the General Regime of Tax Offences.

XI. OTHER PROPOSALS OF THE STATE BUDGET PROPOSAL

These measures are included in the "Other tax-related provisions" chapter of the government's 2025 State Budget Bill, which are mainly located in the field of taxes and so-called sectoral financial contributions.

This chapter has been used by the budgetary legislator to extend the validity of the different sectoral financial contributions that have been created since 2011.

It is becoming clearer that even the supposedly extraordinary contributions are here to stay.

CONTRIBUTION TO AUDIOVISUALS

It is proposed not to update, in 2025, the amounts of the audiovisual contribution created in 2003, maintaining the monthly amounts of € 2.85, currently in force, charged on electricity bills.

CONTRIBUTION TO THE BANKING SECTOR

Like the Budget Laws of previous years, it is proposed that the Banking Sector Contribution (CSB), created by the government's 2011 State Budget Law to finance the Resolution Fund, be maintained in 2025.

The CSB is levied on the liabilities calculated by the taxable persons less, where applicable, the liability elements that make up the own funds of deposits covered by the guarantee of the Deposit Guarantee Fund, the Mutual Agricultural Credit Guarantee Fund, or by a deposit guarantee scheme officially recognised under the terms of the applicable European legislation or considered equivalent under the terms of the General Regime for Credit Institutions and Financial Companies, and deposits at the Central Bank made by mutual agricultural credit banks belonging to the integrated mutual agricultural credit system, on the notional value of off-balance sheet derivative financial instruments calculated by taxable persons.

SOLIDARITY SURCHARGE ON THE BANKING SECTOR

Despite the fact that the Constitutional Court has already ruled that the Additional Solidarity Charge for the Banking Sector (ASSB) is unconstitutional on the grounds that it violates the principle of equality, which prohibits arbitrariness, and that it violates the principle of ability to pay as a result of the principle of equal taxation, namely in Ruling no. 529/2024, handed down on 2 July 2024, and in Summary Ruling no. 459/2024, handed down on 29 July 2024.Ruling no. 529/2024, handed down on 2 July 2024, and Summary Decision no. 458/2024, handed down on 29 July 2024, provide for the continuation, in 2025, of the solidarity surcharge on the banking sector, created in 2020.

The solidarity surcharge is aimed at (i) credit institutions with their main and effective management headquarters in Portuguese territory, (ii) subsidiaries in Portugal of credit institutions that do not have their main and effective management headquarters in Portuguese territory and (iii) branches in Portugal of credit institutions with their main and effective headquarters outside Portuguese territory.

The applicable rate corresponds to the application of a percentage of 0.02 per cent on the values of the liabilities of the banking institutions covered, plus the application of a percentage of 0.00005 per cent on the notional value of the off-balance sheet derivative financial instruments of these same entities.

CONTRIBUTION TO THE PHARMACEUTICAL INDUSTRY

It is also proposed to extend the validity of the Extraordinary Contribution on the Pharmaceutical Industry (CEIF), introduced by the 2015 State Budget Law (Law no. 82-B/2014, of 31 December).

Entities that carry out the first sale of medicinal products for human use for consideration in Portugal are subject to CEIF, whether they are: (i) marketing authorisation or registration holders; (ii) representatives, intermediaries or wholesale distributors; (iii) marketers of medicinal products under an exceptional use authorisation or an exceptional authorisation.

The CEIF is levied on the total value of sales of medicines made in each quarter, specifically: (i) medicines reimbursed by the state at their price, (ii) medicines subject to restricted medical prescription, (iii) medicines with exceptional use authorisation or exceptional authorisation, (iv) medicinal gases and derivatives of human blood and plasma, (v) other medicines whose packaging is intended for consumption in hospital settings, (vi) and orphan medicines.

The applicable rates vary according to the type of medicine, ranging from 2.5 per cent to 14.3 per cent.

EXTRAORDINARY LEVY ON SUPPLIERS TO THE NATIONAL HEALTH SERVICE MEDICAL DEVICES INDUSTRY

The extraordinary levy on suppliers of medical devices to the National Health Service (SNS) is also expected to remain in force, the revenue from which should be automatically included in its budget.

Suppliers - whether manufacturers, their agents or representatives, intermediaries, wholesale distributors or just commercialisers - who invoice NHS entities for the supply of medical devices and in vitro diagnostic medical devices and their accessories are liable to pay the Contribution.

The Contribution is levied on the total amount of quarterly invoicing for the supply of medical devices and in vitro diagnostic medical devices to NHS organisations, which is determined based on the procurement data reported by NHS services and establishments, minus the respective VAT.

The rates are 4 per cent if the annual value is greater than or equal to € 10 million, 2.5 per cent if the annual value is greater than or equal to € 5 million and less than €10 million, and 1.5 per cent if the annual value is greater than or equal to € 2 million and less than € 5 million (which means that the minimum contribution is € 30,000.00).

Lastly, it continues to be stipulated that large medical devices and in vitro diagnostic medical devices intended for treatment and diagnosis are excluded from the levy, i.e. equipment intended to be installed, fixed or otherwise attached to a specific location in a healthcare unit so that it cannot be moved or removed without the use of instruments or apparatus, and which is not specifically intended for use in the context of a mobile healthcare unit.

EXTRAORDINARY LEVY ON THE ENERGY SECTOR

Once again, it is proposed to extend the validity of the Extraordinary Contribution on the Energy Sector (CESE), which has been consolidated in the tax system since its creation in 2014.

The CESE is levied on natural or legal persons who are part of the national energy sector and who have their domicile or registered office, effective management or permanent establishment in Portugal. Only companies that hold an operating licence for electricity production centres or an electricity production licence, concessionaires for electricity transmission or distribution activities, concessionaires for natural gas transmission, distribution or storage activities, holders of a local natural gas distribution licence, crude oil refining and oil product processing or distribution operators, wholesale traders in electricity, crude oil or oil products are subject to the CESE.

***

Rogério Fernandes Ferreira

Marta Machado de Almeida

Vânia Codeço

Duarte Ornelas Monteiro

Álvaro Silveira de Meneses

Patrícia Largueiras

Joana Marques Alves

José Pedro Barros

Miriam Campos Dionísio

Romy Alfredo Bouery

João de Freitas Jacob

Álvaro Pinto Marques

Mariana Baptista de Freitas

Sara Mendes Fernandes

Ana Sofia Gariso

Amélia Carvela

Bárbara Malheiro Ferreira

Alice Ferraz de Andrade

Carlos Alcântara Neves

José Nuno Vilaça

Pedro Santos Gomes

João Aguiar Câmara

Inês Marques Dias

Miriam Vicente

Inês Dias Pinho

Maria Antónia Silva

Marta Arnaut Pombeiro

Joana Fidalgo Barreiro

Nicolas Corrêa Simonini

Raquel Tomé Castelo

***

Manuel Teixeira Fernandes

João Costa Andrade

Rosa Freitas Soares