The Tax Regime of the Incentive to the Capitalization of Companies

The Tax Regime of the Incentive to the Capitalization of Companies

The Tax Regime of the Incentive to the Capitalization of Companies was introduced by the 2023 State Budget Law and has since been amended in the 2024 State Budget Law. The aim of the creation and subsequent amendment of the scheme is to promote the capitalization of companies, encouraging the use of equity instruments to raise the capital necessary for the financial health and promotion of business investment.

FRAMEWORK

Enshrined in the State Budget Law for 2023 and inspired by the proposal for a Directive on the debt-equity bias reduction allowance (DEBRA), the tax incentive scheme for the capitalization of companies (ICE Scheme) allows for a deduction from taxable income of a percentage of the net increase in equity realized in the period in question.

It should be remembered that the approval of this scheme meant the revocation of two previously existing tax benefits, the Conventional Remuneration of Share Capital (RCCS) and the Deduction for Retained and Reinvested Profits, which the ICE Scheme aims to replace.

With the approval of the State Budget Law for 2024, the ICE Scheme was amended, namely with regard to the amount and limit of the annual deduction allowed, as well as its temporal application.

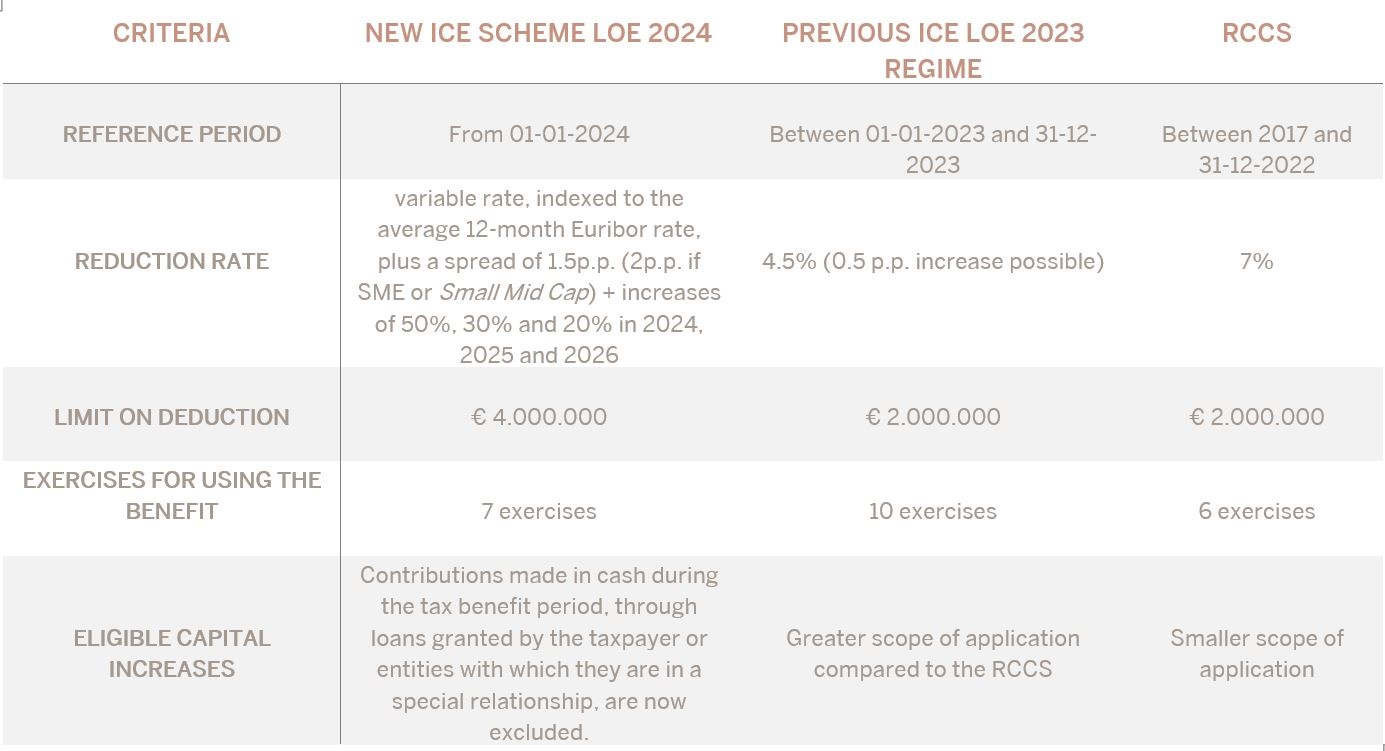

At the end of this newsletter, we present a summary table comparing the ICE (2023 and 2024) and RCCS schemes.

ELIGIBLE BENEFICIARIES

Eligible beneficiaries are commercial or civil companies in commercial form, cooperatives, public companies and other legal persons governed by public or private law, with their registered office or effective management in Portuguese territory.

However, it is necessary that, in the financial year in question, these entities:

- are principally engaged in commercial, industrial or agricultural activities;

- are not entities subject to supervision by the Bank of Portugal or the Insurance and Pension Funds Supervisory Authority, or branches in Portugal of credit institutions, other financial institutions or insurance companies;

- have properly organized accounts;

- its taxable profit is not determined by indirect methods; and

- have their tax and social security situation in order.

THE BENEFIT

The benefit translates into the possibility of deducting, from the entity's taxable profit, an amount to be determined in accordance with the rules of the scheme, determined by applying a rate to the amount of eligible net increases in equity.

The use of this tax benefit is made via the CIT Model 22 declaration for the financial year in question. The amount of the benefit must be entered in field 774 of table 07, and the data relating to its calculation, among other things, must be reported, as illustrated below.

INCREASES IN ELIGIBLE OWN CAPITAL

As mentioned, the benefit is applicable at company level by applying a rate to the net increase in its eligible equity. This means that it is not simply a matter of applying a rate to the value of a capital increase, as in previous regimes, but that it is necessary to validate, in each financial year, whether this increase represents a net increase, by checking the balance of the transactions eligible to the scheme in the period.

The law foresees that the following operations are eligible increases:

- contributions, made in cash, as part of the incorporation of companies or an increase in the share capital of the beneficiary company

- contributions in kind by converting loans into capital

- share premiums, and

- the application to retained earnings, reserves or capital increases of accounting profits that in that year may be distributed, in accordance with corporate legislation.

Eligible withdrawals/decreases are those made, in cash or in kind, in favor of the owners of the capital, by way of capital reduction, sharing of assets, and distributions of reserves or retained earnings.

A balance of eligible increases and withdrawals in a given period is made in order to determine the amount to which the ICE scheme rate will apply, and the resulting figure is the incentive amount to be deducted in that year to the taxable income. If the balance is negative, the amount of net increases in eligible equity for the year is zero.

NON-ELIGIBLE INCREASES IN EQUITY

In order to combat possible abusive or difficult-to-control practices, the legislator established the exclusion, as eligible increases, of contributions to the incorporation or capital increase of companies, when financed by increases in eligible equity capital in another entity, or cash contributions made by an entity that is not resident for tax purposes in a Member State of the European Union, or in the European Economic Area or in another State with which Portugal has not entered into an international double taxation treaty, bilateral or multilateral agreement providing for the exchange of information for tax purposes.

Eligible increases in equity are not considered to be those resulting from cash contributions made in the form of loans granted by the taxable person or entities with which they have a special relationship. However, an exception is made if the taxable person proves that these loans were for other purposes.

THE APPLICABLE ICE SCHEME RATE

With the entry into force of the 2024 State Budget Law, the annual deduction from taxable income provided for in the ICE Regime is now calculated with reference to a rate resulting from a variable rate, corresponding to the average of the 12-month Euribor rate in the tax period, accrued by a spread of 1.5 percentage points (p.p.) - which is 2 p.p. in the case of a small mid cap or MSME.

It should be noted that this incentive is increased in the first years of its validity, with the rate being increased by 50%, 30% and 20% in 2024, 2025 and 2026, respectively.

LIMITS OF THE TAX INCENTIVE

The above deduction may not exceed, in each tax period, the higher of the following limits:

- € 4,000,000 (previously € 2,000,000); or

- 30% of earnings before depreciation, amortization, net financing costs and taxes.

However, in the event that the deduction exceeds the limit of 30% of the result before depreciation, amortization, net financing costs and taxes, the excess part is reportable and deductible in one or more of the five subsequent tax periods, after the deduction for that relevant period and respecting the applicable limit in that year.

REFERENCE PERIOD

Under the terms of the State Budget Law for 2024, for the purposes of calculating the tax benefit, the amount of eligible net increases in equity now includes the increases and withdrawals from the financial year itself and the previous six periods (previously, the same period and the last nine).

CIT MODEL 22 (RELEVANT CONSIDERATIONS)

Among other that may need to be filled, we highlight the following:

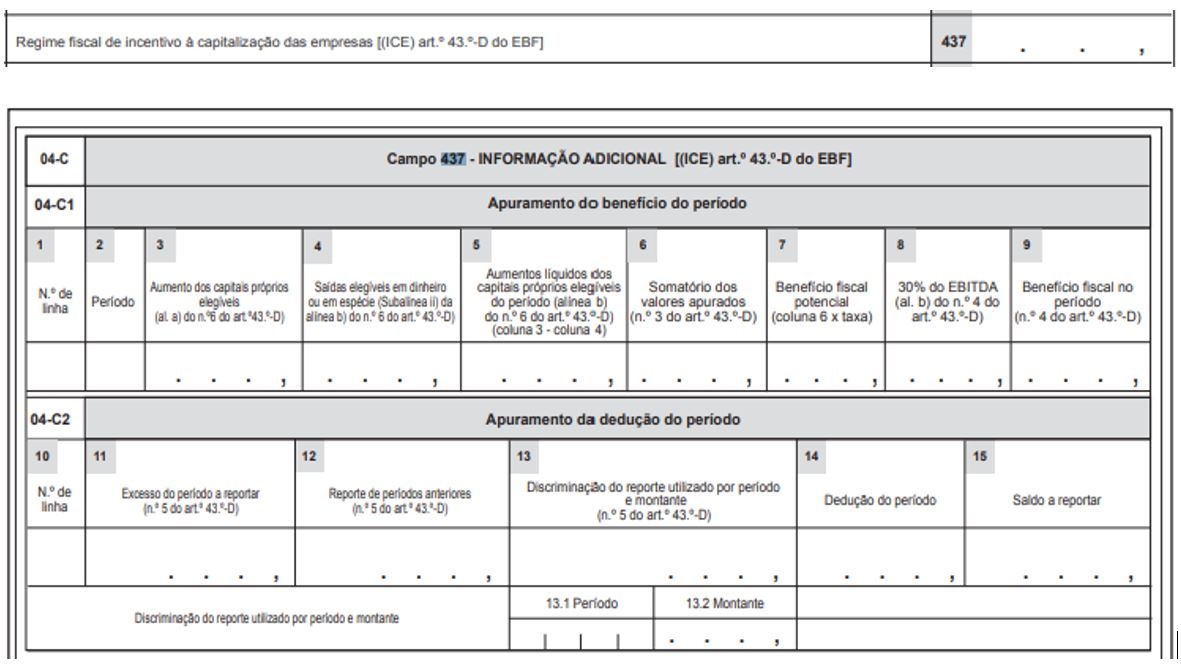

Field 437 of Table 04 of Annex D of Model 22

Annex D applies to the 2011 and subsequent periods and is to be filled in by taxpayers who obtain exempt income or enjoy other tax benefits under CIT.

In field 437, enter the amount of the tax incentive for the capitalization of companies, which should correspond to the amount calculated in column 14 of sub-table 04-C of the said annex, as shown below.

Therefore, entities subject to tax benefits should ensure that the relevant fields in Model 22 are correctly filled in, namely field 774 of table 07 and field 437 of table 04 of Annex D. Considering the recent legislative changes and the importance of the tax incentive to capitalize companies, it is prudent to evaluate these provisions carefully.

CONCLUSIONS

The ICE scheme should be seen in the context of a set of measures aimed at capitalizing companies and ensuring that taxation is neutral in companies' financing decisions, approximating the tax regimes for debt and for equity financing.

Comparing the new ICE regime with the previous regime in force last year, we note that it now provides for a deduction by applying a variable rate indexed to the average Euribor 12 rate, accruing a spread of 1,5% or 2% depending on the size of the company. This deduction is also increased by 50%, 30% and 20% in the 2024, 2025 and 2026 tax periods, respectively.

The comparison between the ICE scheme and the other benefits it replaced is not clear, and we will have to wait and see how the ICE scheme evolves and, in practice, near the beneficiaries, assess its success or failure.

In view of the above, we believe that this could be a relevant benefit for companies to monitor closely.

COMPARITIVE TABLE

The main differences between the New ICE regime enshrined in the State Budget Law for 2024, the previous ICE regime (State Budget Law for 2023) and the Conventional Remuneration of Share Capital Regime (RCCS) can be seen in the table below:

***

Rogério Fernandes Ferreira

Marta Machado de Almeida

Álvaro Silveira de Meneses

Miriam Campos Dionísio

João de Freitas Jacob

José Nuno Vilaça

Joana Fidalgo Barreiro