Real Estate Investment and Real Estate Investment Companies in Portugal

Real Estate Investment and Real Estate Investment Companies in Portugal

Real estate investment has taken on an important role in the Portuguese legal system, particularly attracting foreign capital and enhancing the value of private assets. There is a growing adoption of alternative investment organisations, especially through the creation of Investment Companies for the management of real estate assets. This presentation aims to present the legal framework of the main forms of Real Estate Collective Investment Schemes, with emphasis on the legal regime defined by the Assets Management Regime.

INTRODUCTION

Collective Investment Schemes has taken on a growing role in boosting the Portuguese property market, offering structured and regulated solutions that enable professionalised assets management. Among the various instruments available, Alternative Collective Investment Schemes (OIA) stand out for their versatility and the legal framework provided by the Assets Management Regime (RGA). In this context, it is important to analyse the main forms of OIA, namely Real Estate Investment Funds, Real Estate Investment Companies (SIC) – in their self-managed and managed by a third party variants – as well as the more recent Real Estate Investment and Management Companies (SIGI), with a view to understanding their relevance and impact on the national real estate sector.

LEGAL FRAME

According to the Assets Management Regime (RGA), the legal concept of investment in real estate assets covers the activities of (i) acquiring real estate, (ii) holding units in alternative real estate investment bodies (Real Estate Investment Funds or Real Estate Investment Company) and (iii) holding shares in real estate companies.

OIAs focused on the property sector can include a variety of assets, including urban, rural and mixed properties or their units. In addition, they can also include shares in companies in the real estate sector, units in other investment bodies, derivative financial instruments, as well as assets of a more liquid nature, such as bank deposits for immediate mobilisation, certificates of deposit, holdings in money market funds (traditional or short-term) and financial instruments issued or guaranteed by member states, provided they have a maturity of less than 12 months.

Additionally, as already mentioned, real estate OIAs can be organised in two different ways:

- contractual mode, through Real Estate Investment Funds

- corporate mode, through the formation of Real Estate Investment Companies (SIC).

The main difference between a SIC and an Investment Fund lies in the fact that the SIC has its own legal personality and is therefore an autonomous entity with recognised legal existence.

REAL ESTATE INVESTMENT COMPANIES

The legislation establishes different categories of Real Estate Investment Companies (SIC), which can be classified according two main criteria:

Based on the share capital structure:

- variable Capital SIC (SICAV): these companies are open-ended collective investment organisations, i.e. their share capital is automatically adjusted to the total value of the assets, varying according to the subscriptions and redemptions made by investors, which can occur at any time.

- fixed Capital SIC (SICAF): in this case, it is a closed collective investment organisation, in which the share capital is established when the company is formed. This amount can, however, be increased or reduced following the procedures set out in the Commercial Companies Code.

Based on the management model adopted:

- SIC managed by a third party: the administration and management of the investments is assigned to a specialised external entity – the Management Company – responsible for managing the assets.

- SIC self-managed: As the name implies, in these companies the management is carried out internally, being the responsibility of the entity's own management bodies.

The Assets Management Regime (RGA) establishes a set of essential requirements for the creation of a Real Estate Investment Companies (SIC), which can be summarised as follows:

- SIC must adopt the legal form of a public limited company

- incorporation requires prior authorisation or communication from the Portuguese Securities Market Commission (CMVM)

- head office and the central and effective administration must be in national territory, which implies the application of Portuguese law as the main legal rule

- minimum share capital required varies between € 50.000 and € 300.000, depending on whether it is a SIC managed by a third party or self-managed SIC, respectively.

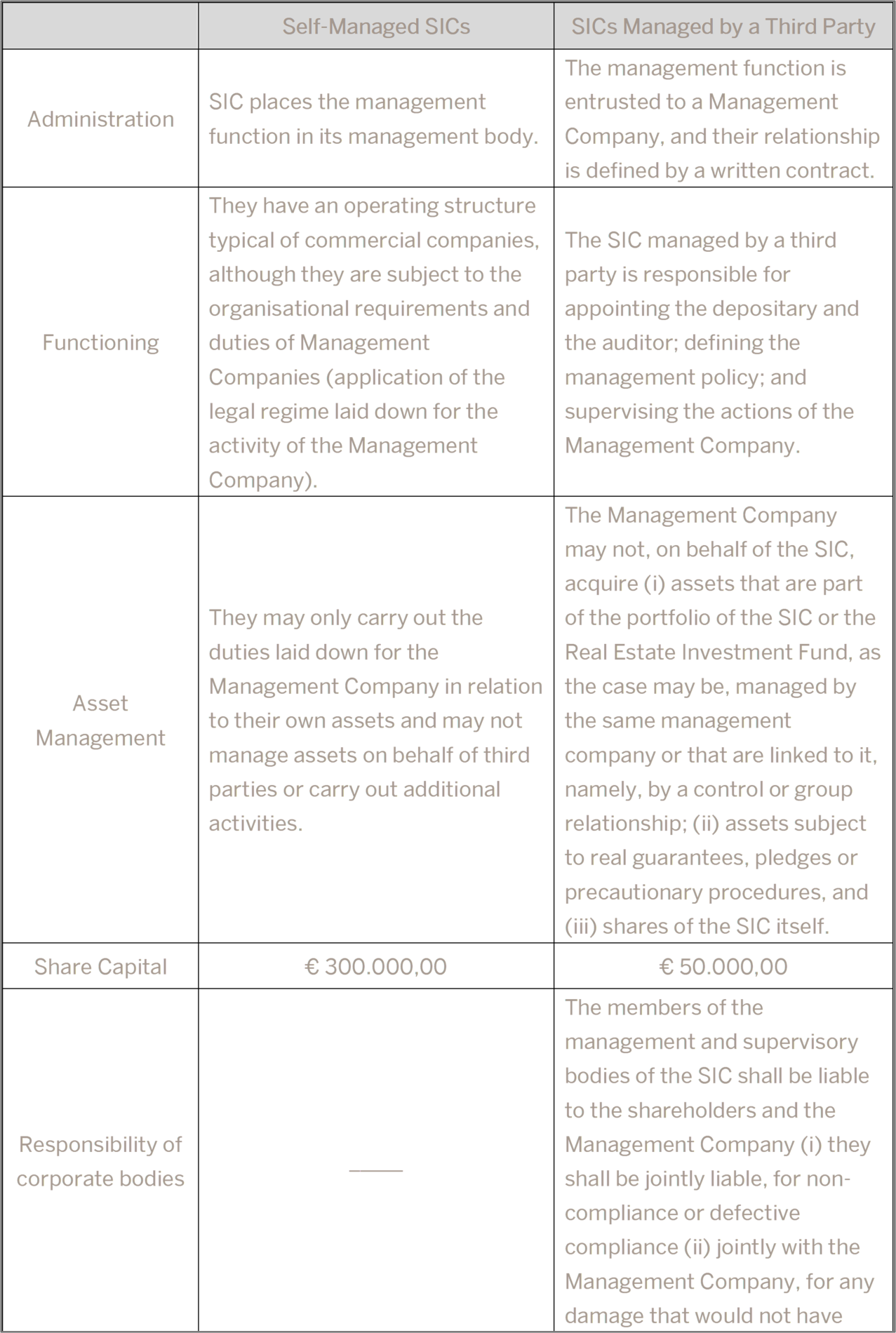

The RGA also stipulates that self-managed SICs are subject to the same legal regime applicable to Management Companies, namely regarding their functions, duties, conduct, organisational structure, remuneration policies and charges.

Regarding SICs managed by a third party, the RGA clearly defines which competences are attributed to the company itself and the ones attributed to the Management Company. The SIC's management body is responsible for supervising the actions of the Management Company.

Additionally, the members of the management and supervisory bodies of SICs managed by a third party are liable to the shareholders and to the company itself, under the following terms:

- they shall be jointly liable if they fail to fulfil, or do so inadequately, their duties to appoint the depositary and the auditor, to define the management policy and to control the activity of the Management Company

- in solidarity with the Management Company, whenever the resulting loss could have been avoided if its supervisory duties had been correctly carried out.

According to the above, the law makes a clear distinction between the regime applicable to self-managed SICs and the regime applicable to SICs managed by a third party:

REAL ESTATE INVESTMENT AND MANAGEMENT COMPANIES

With relevance to this presentation, it is also important to mention the most recent type of property investment company, the Real Estate Investment and Management Companies (SIGI), which are a new vehicle for promoting investment and boosting the property market, particularly the rental market.

SIGIs are governed by the Real Estate Investment and Management Companies Regime (RSIGI), approved by Decree-Law 19/2019, of 28 January, and by the provisions applicable to public limited companies, since they must adopt this corporate form.

In addition to the obligation to adopt the legal form of a public limited company, Real Estate Investment and Management Companies (SIGI) must cumulatively fulfil the following requirements:

- corporate purpose: must have as their purpose (i) the acquisition of real rights in real estate with a view to rental or other forms of economic exploitation; (ii) the acquisition of holdings in companies with similar objectives and requirements – based in Portugal or in any Member State of the European Union or the European Economic Area; or (iii) the acquisition of shares in property investment funds with income distribution policies compatible with those of SIGIs

- share capital: must have a minimum fully subscribed and paid-up share capital of € 5.000.000, represented exclusively by ordinary shares

- portfolio composition and debt limits: compliance with legal limits on asset structure and maximum debt levels is mandatory

- company name: must contain the designation “Real Estate Investment and Management Companies, S.A.” or the abbreviation “SIGI, S.A.”

- market trading: the shares issued by SIGI must be admitted to trading on a regulated market or integrated into a multilateral trading facility, as established in the applicable legislation.

Additionally, the asset structure of SIGIs should be largely composed of property rights, surface rights or other rights with equivalent economic value over real estate intended for rental or commercial exploitation. These assets must fulfil the following cumulative criteria:

- the rights to real estate and shareholdings must correspond to at least 80% of the overall value of the company's assets

- the properties leased must represent at least 75% of this same total value

- real estate assets and shareholdings must be held for at least three years, and after their sale, at least 75% of the net proceeds must be reinvested within three years in assets eligible under the SIGI scheme

- the company's level of debt may not exceed 60% of the total value of its assets.

CONCLUSIONS

The analysis of the legal and functional framework of OIAs in the real estate sector, based on RGA, leads to the conclusion that they are fundamental instruments for boosting and professionalising real estate investment in Portugal. The possibility of structuring OIAs in contractual (Real Estate Investment Funds) or corporate (Real Estate Investment Companies – SIC) form offers flexibility to investors, adapting to different investment profiles and strategies.

It is also worth highlighting the distinction between self-managed SICs and SICs managed by a third party, with different legal and operational regimes, especially regarding management responsibility, capital structure and supervisory duties. This differentiation aims to ensure greater investor protection and effective supervision, promoting transparency and good corporate governance.

The creation of SIGIs complements the panorama of collective investment schemes, bringing the Portuguese market closer to international practices such as Real Estate Investment Trusts (REITs). SIGIs aim to encourage long-term investment in income-generating real estate assets, especially in the rental market, with demanding capital requirements, transparency and risk dispersion.

In short, OIAs represent fundamental pillars in the modern structuring of real estate investment, allowing for greater professionalisation, liquidity and diversification of the sector, while ensuring a robust regulatory framework in line with the principles of stability, transparency and investor protection.

***

Rogério Fernandes Ferreira

Marta Machado de Almeida

Patrícia Largueiras

Inês Dias de Pinho

Miriam Vicente

Carolina Gomes Alves